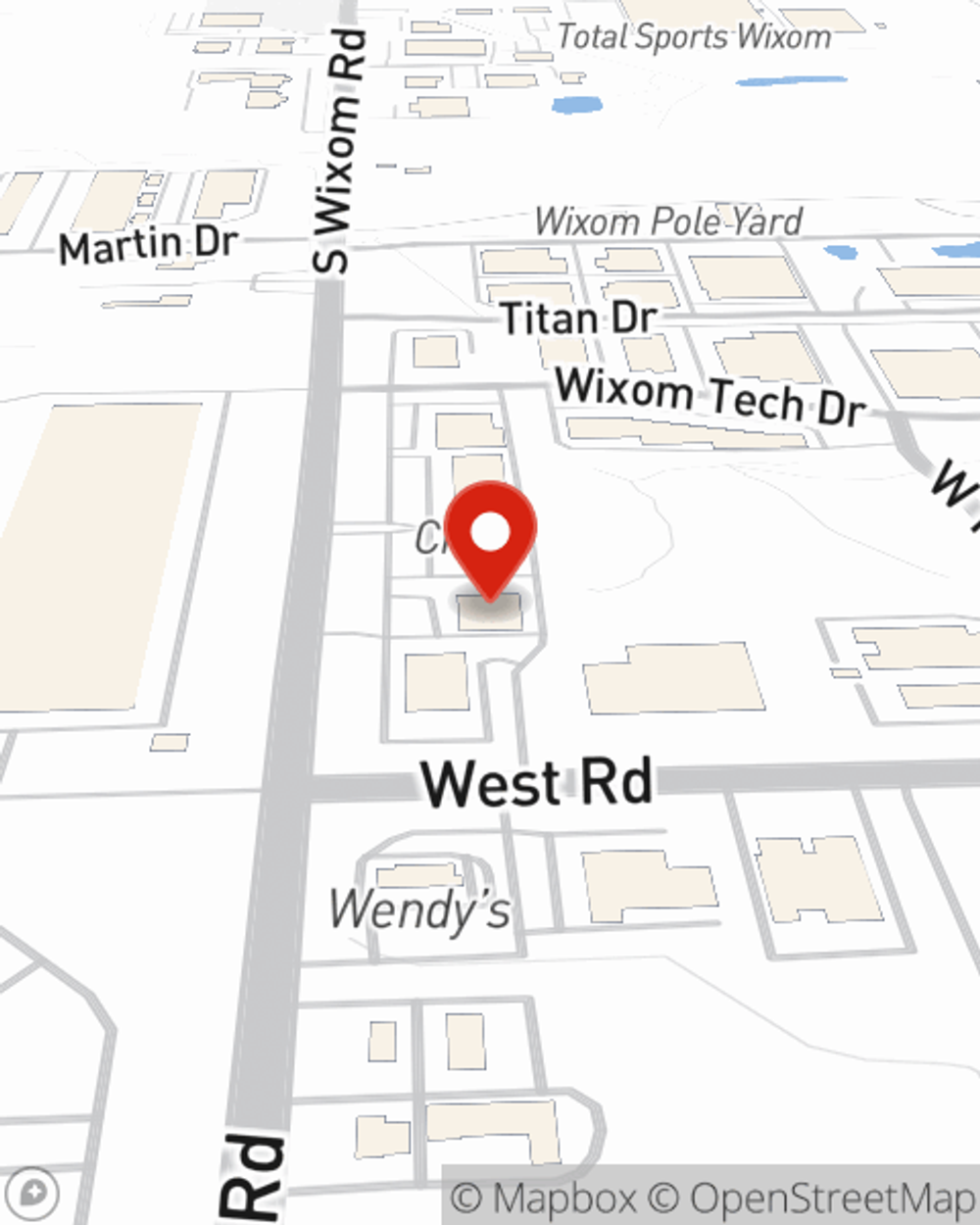

Business Insurance in and around Wixom

Calling all small business owners of Wixom!

Almost 100 years of helping small businesses

Your Search For Outstanding Small Business Insurance Ends Now.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or mishap. And you also want to care for any staff and customers who stumble and fall on your property.

Calling all small business owners of Wixom!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Protecting your business from these potential problems is as easy as choosing State Farm. With this small business insurance, agent Jason Farkas can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

So, take the responsible next step for your business and contact State Farm agent Jason Farkas to investigate your small business insurance options!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Jason Farkas

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.